net investment income tax 2021 trusts

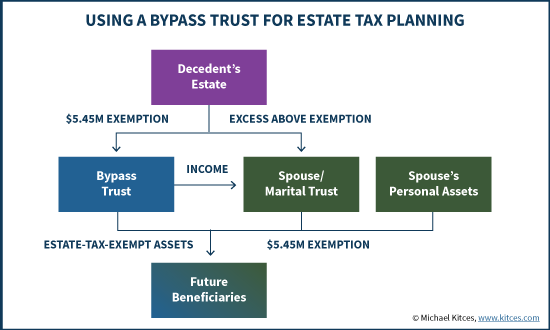

Here the 5000 of capital gain excluded from DNI clearly net investment income is added to the 22500 of net investment income retained by the trust. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

Subject to a 38 unearned income.

. In comparison a single. All About the Net Investment Income Tax. 2021-12-17 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of.

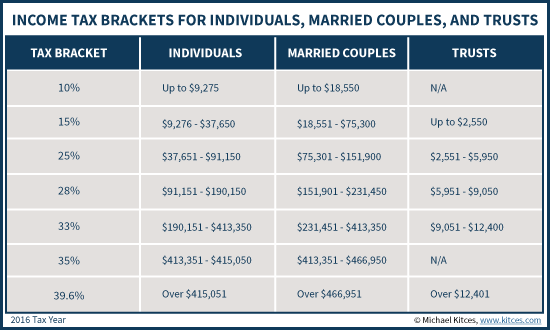

For 2021 a trust is subject to NIIT on the lesser of the undistributed net investment income or the excess of adjusted gross income over of 13050. Since 2013 certain higher-income individuals have been. Tax is assessed on the smaller of the filers net investment income or the excess of MAGI over the applicable threshold amount Maximum alternative minimum tax AMT rate.

If you held the property for one year or less its a. A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office. 1 2013 individual taxpayers are liable for a 38 percent Net.

Generally net investment income includes gross income from interest dividends annuities and royalties. This tax only applies to high-income. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Trusts 60000 of taxable income attributable to the IRA is excluded from net investment income. The 38 Net Investment Income Tax. And very high-income taxpayers may pay a higher effective tax rate because of an additional 38 net investment income tax.

From Simple To Complex Taxes Filing With TurboTax Is Easy. For estates and trusts the 2021 threshold is. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

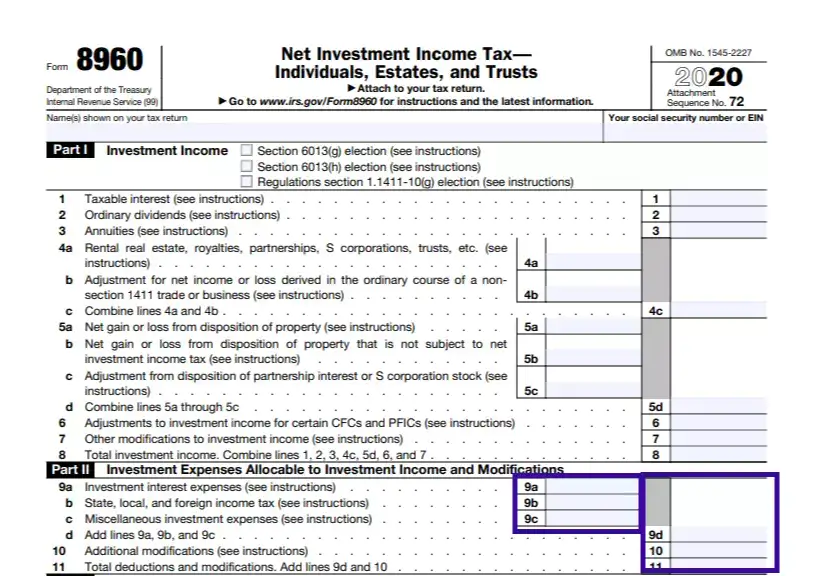

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Thus the total amount. The estates or trusts portion of net investment income tax is calculated on Form.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. Trusts Estates and the Net Investment Income Tax.

Trusts undistributed net investment income is 25000 which is Trusts net. No Tax Knowledge Needed. A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office.

Go to wwwirsgovForm8960 for instructions and the latest information. For the portfolio that includes only assets owned entirely by the REIT Investment Property Portfolio Net Rental Income for the three months ended December 31 2021 Q4. We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960.

If an individual has income from investments the individual may be subject to net investment income tax. When the Patient Protection and Affordable Care Act healthcare reform was passed in 2010 it included a tax increase that. Net Investment Income Tax Individuals Estates and Trusts Attach to your tax return.

According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal.

More about the Federal Form 8960 Other TY 2021. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

How To Calculate The Net Investment Income Properly

Distributable Net Income Tax Rules For Bypass Trusts

What Is The Net Investment Income Tax Caras Shulman

Net Investment Income Tax Niit Quick Guides Asena Advisors

What Is Net Investment Income Tax Overview Of The 3 8 Tax

Applying The New Net Investment Income Tax To Trusts And Estates

Stand For Nav What Is Mean By Nav In 2021 What Is Meant Meant To Be Marketing Definition

Irs Form 8960 Fill Out Printable Pdf Forms Online

What Is The The Net Investment Income Tax Niit Forbes Advisor

Distributable Net Income Tax Rules For Bypass Trusts

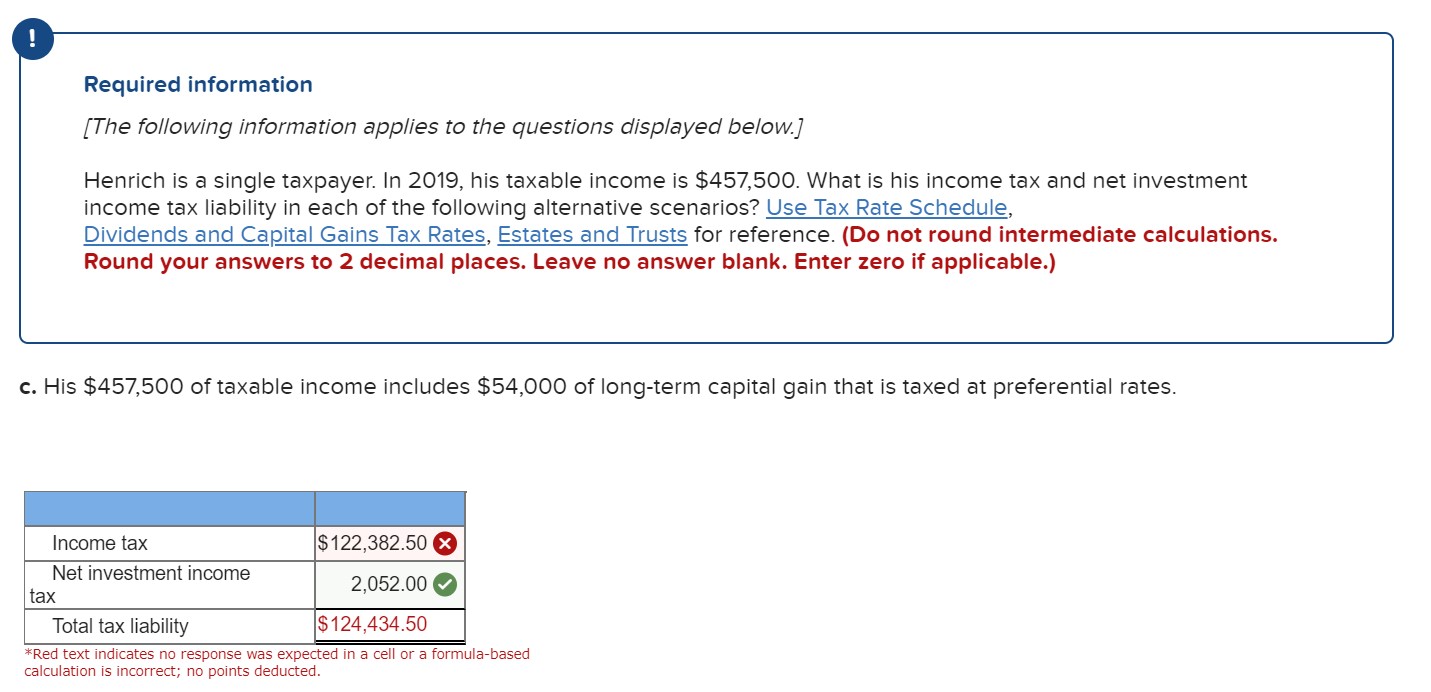

Answered Required Information The Following Bartleby

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

How To Calculate The Net Investment Income Properly

Net Investment Income Tax For 1040 Filers Perkins Co

What Should You Do If A Deceased Family Member Had A Will Or Trust But You Haven T Found It Ti In 2021 Estate Planning Attorney Revocable Living Trust Estate Planning

Applying The New Net Investment Income Tax To Trusts And Estates

Taxcycle T3 Trust Returns Taxcycle

Applying The New Net Investment Income Tax To Trusts And Estates