irs child tax credit 2021

Fast Easy Secure. The expanded child tax credit for 2021 isnt over yet.

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

The monthly payments are advances on 50 of the CTC that you can claim on your 2021 tax returns when you file your taxes in early.

. Is the Child Tax Credit for 2020 or 2021. Access IRS Tax Forms. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Edit PDF Files on the Go. These changes reflect that Publication 972 Child Tax Credit has become obsolete. IR-2022-10 January 11 2022 WASHINGTON The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit.

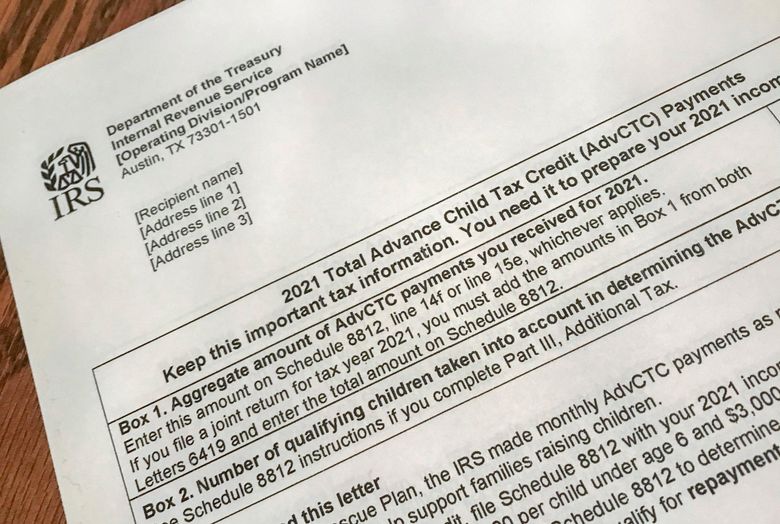

To help taxpayers reconcile and receive 2021 CTC the IRS is sending Letter 6419 Advance Child Tax Credit Reconciliation from late December 2021 through January 2022. Are you using any. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit.

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The Child Tax Credit Update Portal is no longer available.

3000 for children ages. Watch popular content from the following creators. From the IRS to complete your tax filing reconciling the.

The 2021 Earned Income Tax Credit provides a tax break for low-income workers and families based on their wages salaries tips and other pay as well as earnings from self-employment. 150000 for a person who. For 2021 eligible parents or guardians can receive up to 3600 for each child who.

Ad Robust web-based PDF editing solution for businesses of all sizes. Enacted by President Joe Biden in 2021 the American Rescue Plan Act ARP made the EITC available to a greater number of recipients than it was previously. Save Time Editing Documents.

Your amount changes based on the age of your children. The Michigan mother of three including a son with autism. When you go through the process of filling out your 2021 tax return you will be able to claim the full credit for your newborn dependent.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Most families received half of the credit in advance via monthly payments last year but theres still more money to be claimed. Child tax credit affect 2021 tax return 1855M views Discover short videos related to child tax credit affect 2021 tax return on TikTok.

Taxpayers should refer to Schedule 8812 Form 1040. Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

How much is the child tax credit worth. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. As part of its collection activities the IRS saw an increase in the use of Payment Plans.

The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with. If you opt out of advance payments you are choosing to receive your full Child Tax Credit 3600 per child under age 6 and 3000 per child age 6 to 17 when you file your 2021. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ages five and younger is up to 3600 in total up to. Complete Edit or Print Tax Forms Instantly. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

3600 for children ages 5 and under at the end of 2021. Schedule 8812 Form 1040. The payment for children.

If you have children and received child tax credit payments in 2021 youll need a Letter 6419. Almost 24 million taxpayers established new payment plans Installment Agreements. Irs refund child tax credit schedule 2022.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

2021 Child Tax Credit Advanced Payment Option Tas

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Advanced Child Tax Credit What It Means For Your Family

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Irs Cp 08 Potential Child Tax Credit Refund

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit 2021 Who Will Qualify For Up To 1 800 Per Child This Year Fox Business

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Child Tax Credit Payments Start July 15

Child Tax Credit 2021 Changes Grass Roots Taxes

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com